About Irs Erc Ertc 2020-2021 Covid Business Income Tax Refund Program

Wiki Article

5 Simple Techniques For Irs Erc Ertc 2020-2021 Covid Business Income Tax Refund Program

Table of ContentsAll About Irs Erc Ertc 2020-2021 Covid Business Income Tax Refund ProgramFacts About Irs Erc Ertc 2020-2021 Covid Business Income Tax Refund Program UncoveredEverything about Irs Erc Ertc 2020-2021 Covid Business Income Tax Refund ProgramAll about Irs Erc Ertc 2020-2021 Covid Business Income Tax Refund Program

The CARES Act influences AGI by enabling circulations to be strained over three years. For people that select this choice, the distribution income will also be spread across three tax years in Vermont.The circulations that are spread throughout three years will certainly also be spread out across 3 years of home earnings. No. Because the COVID-related distributions will certainly be taxed as gross earnings and also will certainly not go through the Federal 10% extra tax on circulations from qualified strategies, there will certainly not be any kind of extra Vermont tax obligation under this section.

We and the 3rd celebrations that supply content, performance, or organization services on our site might make use of cookies to gather information regarding your browsing activities in order to supply you with even more appropriate web content and advertising materials, on and off the site, and also help us comprehend your passions as well as enhance the site - IRS ERC ERTC 2020-2021 COVID BUSINESS INCOME TAX REFUND PROGRAM.

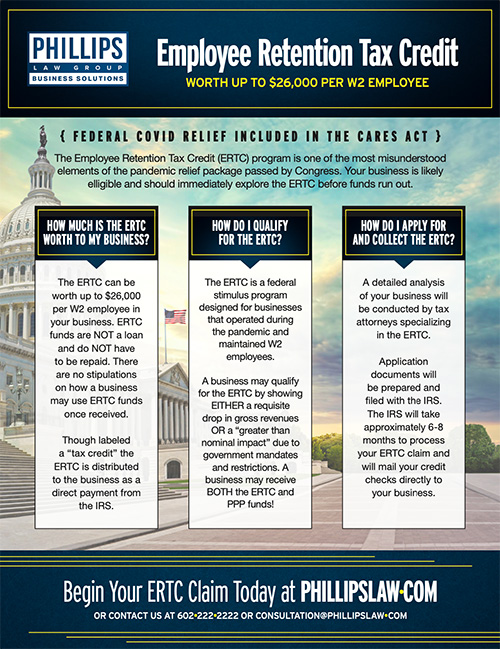

Although the Irs (the "IRS") has actually not rejected any kind of such party the invoice of the tax obligation credit score, in the vast bulk of instances, the customers have actually not yet gotten the funds. At the end of May, the internal revenue service explained the reason of the hold-ups as well as likewise the standing of the backlog - IRS ERC ERTC 2020-2021 COVID BUSINESS INCOME TAX REFUND PROGRAM.

What Does Irs Erc Ertc 2020-2021 Covid Business Income Tax Refund Program Mean?

This has triggered lots of companies that submitted for the ERC to experience a longer than expected tax obligation refund." The IRS has actually noted that they are currently opening their mail within the typical period. The change in treatments, as well as the quantity of demands, have developed a lengthy backlog.

Including 2021 returns, nevertheless, the number of unprocessed 941s (which, once more, in IRS talk includes the 941-X) swells to 1. It is re-routing tax obligation returns from IRS Click Here offices that are even more useful link behind to those that have more team availability.

The Ultimate Guide To Irs Erc Ertc 2020-2021 Covid Business Income Tax Refund Program

The IRS delays must not cause employers that are qualified to the tax obligation debt based on their reporting settings to hesitate to pursue such funds.The ERC is considered a conditional grant, as an organization just certifies for the transfer of assets if it has actually conquered the barrier of qualification. Per ASU 958-10-75-2: conditional assurances to offer, which have donor-imposed problems that stand for a barrier that should be gotten over as well as a right of release from obligation will be identified when the problem or problems on which they depend are considerably met, that is, when a conditional assurance becomes unconditional.

If the barriers have been satisfied as indicated over, a receivable ought to be identified for the section that has actually not been gotten, even if the kinds have not been submitted. Filing the kinds is an administrative feature as well as is ruled out a barrier to revenue acknowledgment. To properly record the profits and associated receivable, it is essential to have actually determined eligibility, computed the credit history, and also, ideally, be in the process of submitting the forms prior to taping the receivable.

In keeping with correct accountancy therapy for nonprofits, expenses and payments need to be recorded gross. The pay-roll tax obligation will certainly be built up for the whole amount prior to the application of the ERC. The ERC is taped as either a debit to cash or balance dues and also a debt to contribution or grant income, according to the timeline kept in mind above.

Not known Facts About Irs Erc Ertc 2020-2021 Covid Business Income Tax Refund Program

When the revenue is site link videotaped, it is unrestricted, as any suggested time limitation would have been fulfilled upon the due day of the receivable. Additionally, there is no objective limitation affixed to the ERC.Statement of Financial Placement An existing receivable must be tape-recorded for the ERC amount that was not taken as a credit score on pay-roll tax reporting types. (You can claim a debt that is greater than the tax obligations due on Form 941, Company's Quarterly Federal Tax Return.) Notes Reveal even more details concerning the nature of the ERC in either earnings or the A/R explanation, similar to this instance: Laws as well as laws worrying government programs, including the Staff member Retention Credit established by the Coronavirus Help, Alleviation, and Economic Safety (CARES) Act, are complex as well as based on differing interpretations.

There can be no guarantee that regulatory authorities will not test the Organization's case to the ERC, and it is not possible to figure out the influence (if any) this would have upon the Company. With any luck, these factors to consider help you as you figure out just how to make up the ERC in your organization and show the credit report in your records.

Report this wiki page